Introduction

QuickBooks Desktop software is software that has always been used by almost every organization in the western hemisphere. The software is full of multiple features and functions. Talking about the different features, you can also make the Gross Sales Report in QuickBooks an essential aspect of accounting.

Gross Sales Report in QuickBooks

Recognizing and recording income is an important and challenging job for accountants. Many investors report their earnings, and the difference between net and gross sales for a small company may have substantial tax implications if done correctly. At the same time, there are a few grey areas in acknowledgement and reporting, all earned revenue from sales transactions may be classified as either gross or net.

- Recognizing and recording income is an important and challenging job for accountants.

- How revenue is collected and reported is of importance to investors and financial experts.

- All money from a sale is accounted for on the income statement when gross revenue is reported. Any expenditures, regardless of source, are not taken into consideration.

- Instead, net revenue is calculated by deducting the cost of products sold from gross income, which provides a more realistic picture of the bottom line.

Read more about: “QuickBooks Won’t Open”

Gross Revenue (or Gross Sales) Reporting: When gross revenue (or gross sales) is reported, all sales money is accounted for on the income statement. Any expenditures, regardless of source, are not taken into consideration. The cost of goods sold (COGS) is not included in gross revenue reporting, which focuses only on sales income. Even if a pair of shoes cost $40 to manufacture, a shoemaker’s total revenue is $100 if they sell for $100. Under generally recognized accounting rules, the Emerging Issues Task Force, or EITF 99-19, addressed conventional gross vs net revenue reporting principles (GAAP).

Net Revenue: Net revenue (or net sales) is calculated by deducting the cost of goods sold from gross income and summing what’s left on the “bottom line.” For the same shoemaker, net sales for a $100 pair of shoes that cost $40 to produce will be $60. All other costs, such as rent, wages for additional workers, packing, and so forth, will be deducted from the $60. Any expenses incurred by the shoemaker are subtracted from the gross revenue of $100, leaving the net profit. When a commission must be recorded, or a supplier gets a portion of the sales money, net revenue is reported. A typical example is legal fees, in which an attorney nearly always gets a percentage of the net profits of a case. They will get a more significant settlement amount since the ratio is derived from a more prominent beginning figure.

What is the best way to locate my gross revenues in QuickBooks Desktop software?

You can keep track of your income and how far your company has progressed. This is how you do it:

- Select Reports from the left menu.

- Type Profit and Loss into the search box.

- From the drop-down option, choose Customize.

- Select a date in the Report period area.

- It’s just a matter of turning on the faucet to activate the filter.

- Check the box next to Distribution Account in the Income Accounts section.

- Run is the subject of a report.

These are the steps that will help you locate the gross revenues in QuickBooks Desktop software, and now that you know that you can read the next segment, that will help you run a gross sales report in QuickBooks Desktop software.

In QuickBooks Desktop, how can I run a gross sales report?

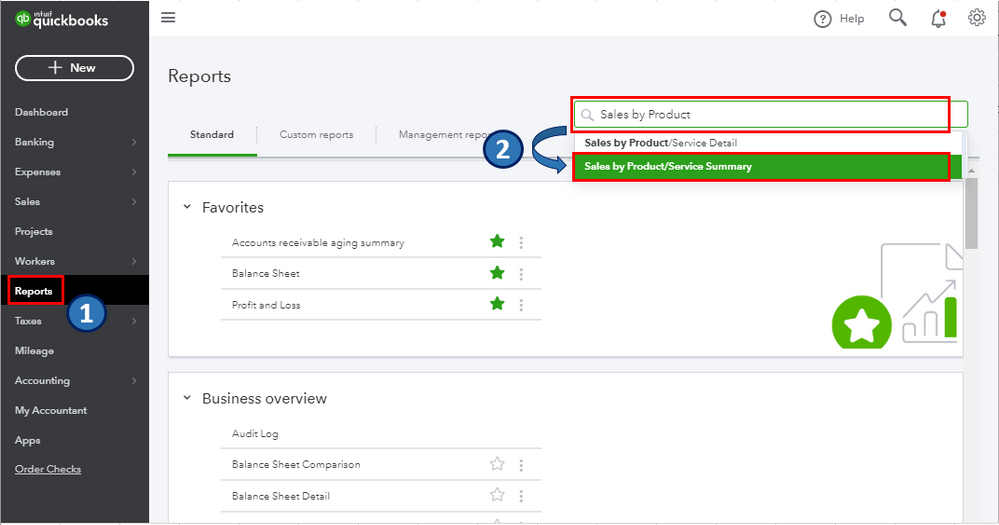

In QuickBooks Online, there isn’t a chart that shows monthly gross sales. On the Sales by Product/Service Summary report, you may change the month’s date range. This is how you do it:

- Click Reports on the right.

- After that, you need to type “Sales by Product.” in the search box.

- The report will display below you as you write. When the information is displayed, click it to execute it.

These are the steps that will help you to run a gross sales report in QuickBooks Desktop software. If in case you are not able to perform any of the steps or have problems with anything related to QuickBooks Desktop software, you can talk to one of our QuickBooks Technician at QuickBooks Error Support.

Conclusion

In conclusion, QuickBooks Desktop software is one prevalent accounting software and has so many features, and functions and Gross Sales Report in QuickBooks is one of them, and that is what the blog is all about. I hope that this blog proves to be a little helpful and was worth your time.