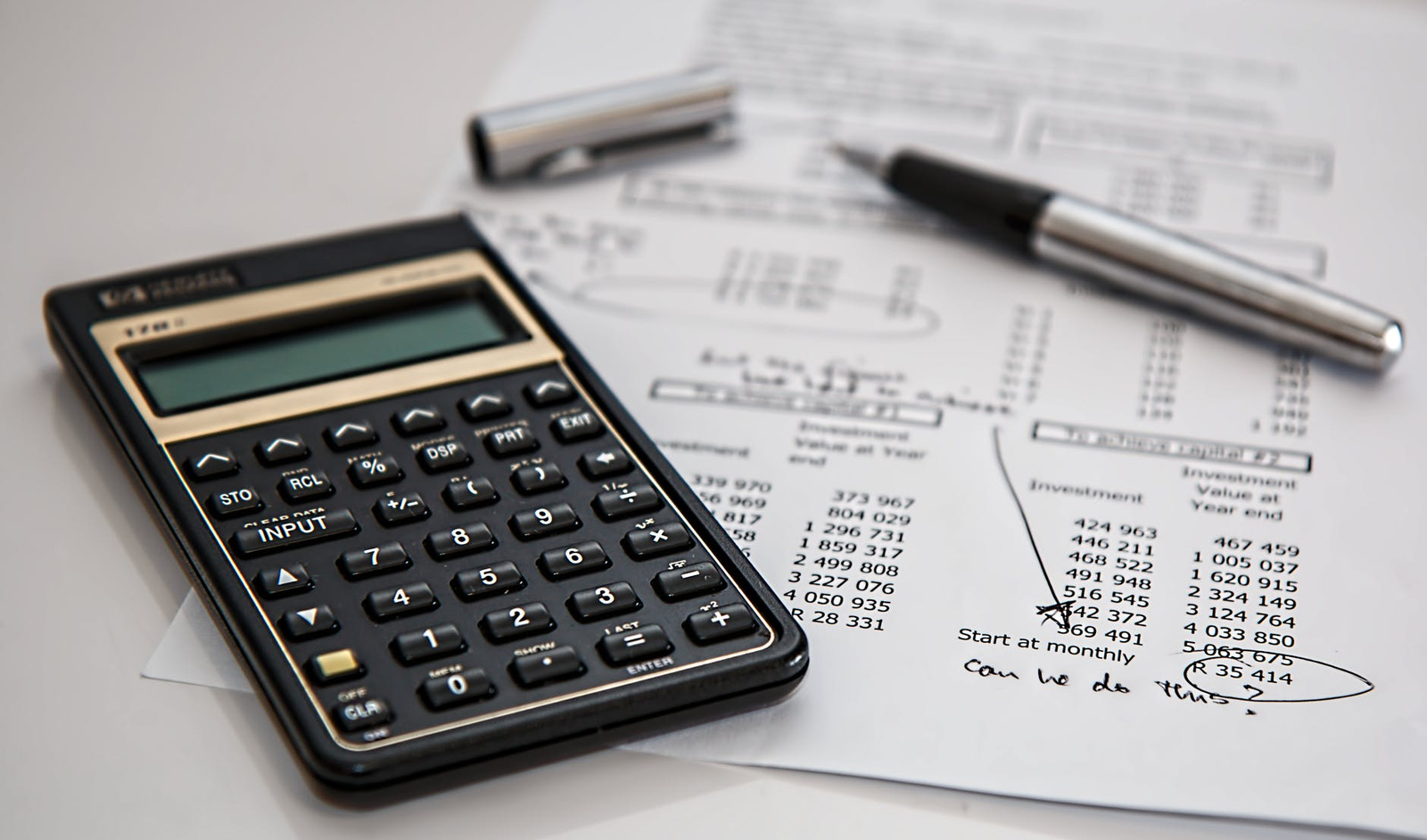

The best way to borrow at the time of need is with the help of an EMI calculator. An EMI calculator had indeed made borrowing very easy and manageable. Taking a huge decision like borrowing is not an easy matter. There are a lot of things that need to be considered. If you are good at calculations, or if you are not, it does not matter when borrowing. For a personal loan online, you always need to be very sure about your numbers. A small fractional error can lead to a big mess in the future. It is important for you to calculate all your loan related calculations with the help of an EMI calculator. It is easy and affordable. An EMI calculator is a must-have for borrowing. It makes borrowing easy and hassle-free when you get the best personal loan that has the lowest cost. You get it completely free to use when you visit the website of Clix Capital. Make sure you don’t count on manual calculation and mess up your instant personal loan online.

What is an EMI calculator?

A personal loan calculator calculates like your simple used calculator in daily life. However, the purpose of usage is different. An EMI calculator is only used to calculate the amount borrowed. It is used to calculate EMI, rates, and various other loan-related calculations. It has a simple interface that only has two or three functions, like EMI and rate of interest calculations. It is easy to use and you can access it on any online financial borrowing website like Clix Capital. The benefits of using an EMI calculator are huge.

Advantages of Using an EMI Calculator

- Accuracy: There is no chance of miscalculations. If you use an EMI calculator, you can easily do the long and complicated loan calculations without any hurdles. There will not be any miscalculations unless you make mistakes in inputting the right details. The EMI calculator will provide 100% accurate results. You can be very sure about the right results and there will be no hurdle in getting the right answers and it will be very easy to borrow for you. If you need the best experience of getting an accurate amount of EMI and rate of interest before you borrow, you definitely need an EMI calculator. It is known for the accurate amount it offers.

- Quick: An EMI calculator is very quick when it comes to calculations. No matter how complicated the calculations are, the EMI calculator can easily do them within a few seconds. This makes it easy for the borrower to quickly work on various aspects like the EMI, rate of interest, and the borrowing comparison. It will help you borrow more quickly than the majority of the borrowing options. It is worth having an EMI calculator that offers you instant calculations.

- Simple and easy: An EMI calculator is very simple and easy to use. The interface is easy for users to quickly use without the need for complicated technical support. The simple interface will guide the users through conducting the calculations. It does not have too many operations or factors that can confuse the user. It only does two to three loan calculations, and it will be easy as the steps will be mentioned one after another in an EMI calculator.

- Managing EMI: When you get an EMI calculator, you get to calculate your EMI at home before you visit your loan provider. By making changes to the principal amount or tenure, you can quickly keep computing the EMI number till you find the amount that you are comfortable with paying. When you feel that your EMI is more, you can simply change your tenure and increase the tenure, and you will find that your EMI decreases. Similarly, if you feel your EMI is low and you want to afford a high EMI to quickly finish off the loan, you can shorten the loan tenure to get a high EMI. It is a useful tool where you definitely don’t need to suggest or tell you about the EMI that you have to pay every month.

- Compare loans: It is important to compare the loan options in the market. Make sure you use the EMI calculator to compare all the existing loan options that are available. When you use an EMI calculator, you will be able to calculate the EMI, rates, and rate of interest of various loan providers. This way, you can actually find out the total loan cost offered by all of the loan providers. When you know the total loan cost from the best loan providers, you will be able to quickly deliver the right loan. It will help you with the right borrowing experience.

Finishing up

The personal loan online process is smooth and affordable. You can easily apply online with the help of a personal loan calculator. This will make your borrowing experience great and you will also get the best personal loan. Compare and choose the right options for instant personal loan online.